- The Travis.vc Newsletter

- Posts

- Banana-land markets: The bull case few want to make

Banana-land markets: The bull case few want to make

8 reasons for optimism when everything looks batshit crazy

Yesterday the very nice and very hard to spell Nick Maggiulli posted the question:

And honestly? It does seem like we’re in banana-land.

Nothing makes sense.

Up-only.

Same story in almost every metric you look at.

The trusty Buffett Indicator?

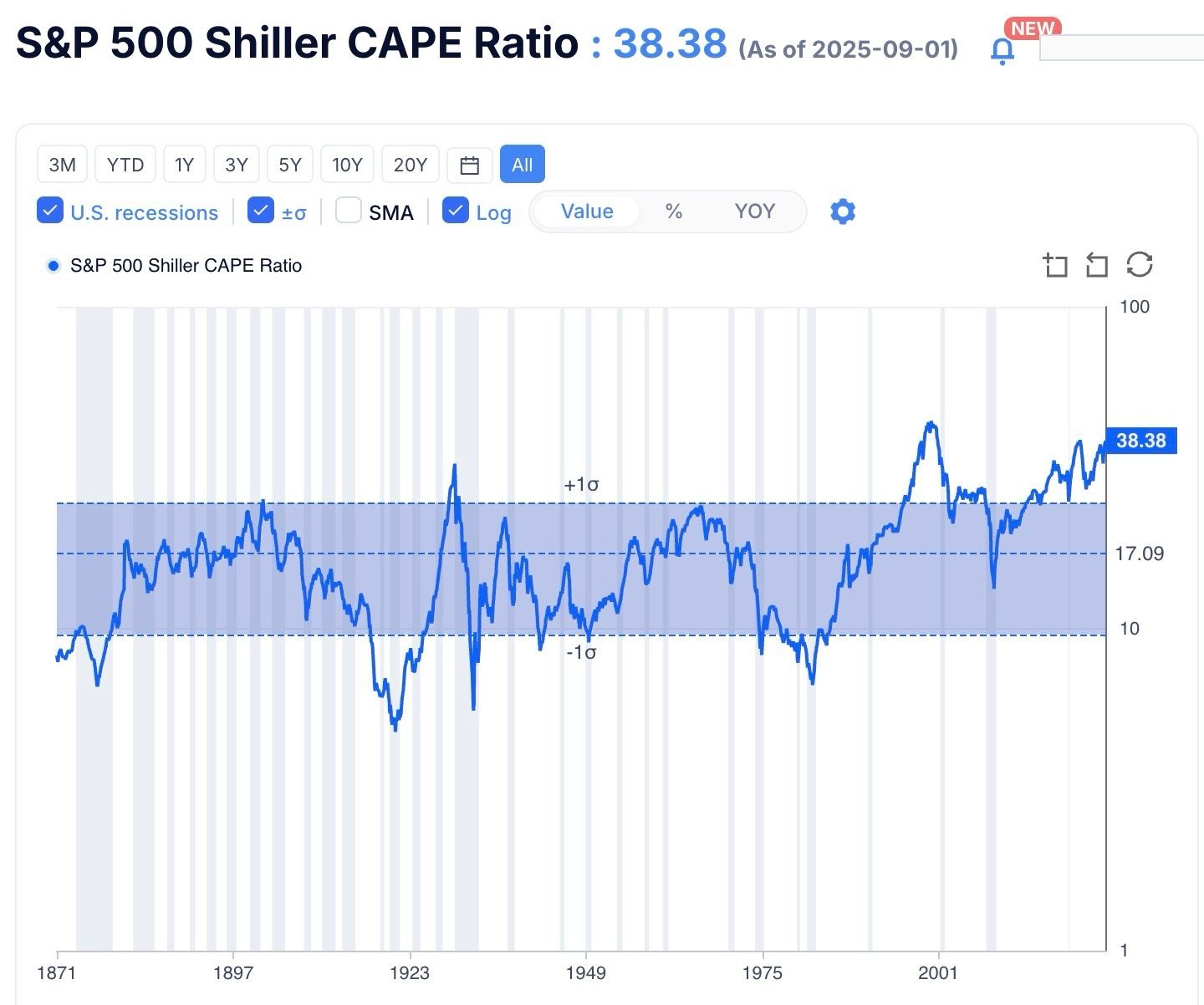

Shiller CAPE?

All show U.S. stocks have overheated.

So, given all of this, how could an investor actually be bullish on U.S. stocks?

I’m not claiming to have that specific belief here.

But, even if one believes we’re headed back to the stone age, It’s still useful to be able to make an argument both ways, so I took a stab.

As our sorely missed wise grumpy grandpappy said:

“I never allow myself to hold an opinion on anything that I don't know the other side's argument better than they do.”

So here is my attempt at explaining just how a reasonable person could be optimistic on U.S. equities in this time of extremes.

#1 - The big companies moving the market are better than any we've ever seen before

This is not even a question.

This is a fact.

The amount of cash generated by these big tech companies would have been unfathomable even 20 years ago.

#2 - The market is forward-looking to fed rate cuts

The market is never looking at this moment in time, it’s always looking into the future as best it can.

The market sees the political pressure on the Fed, sees the deteriorating jobs numbers, and assumes that meaningful rate cuts are on the way.

Lower rates are just about the #1 lever around to boost asset prices.

#3 - Currency devaluation

Bitcoiners love to make this claim.

The narrative goes something like -

“the price of Bitcoin hasn’t gone up, the value of the dollar went down”.

Some would claim the same thing here, or at least that investors are terrified of fiat and are grasping at anything to preserve wealth.

I’m sure there are some interesting charts around this.

(send them to me if you know of any)

#4 - Passive investor inflows are all that matter

In today’s climate of passive investors, BogleHeads, and SPY-or-die investors, the valuations simply don’t matter much anymore.

Fund flows are the new name of the game.

And very significant funds will flow into the market every single day as millions of retail investors dollar-cost-average into an S&P500 index vehicle.

#5 - High profit margins

The S&P 500 is achieving the highest profit margins in decades.

Investors naturally pay up more for better companies.

#6 - AI

AI blah blah blah.

Enough has been said on this already.

Whether you buy it or not, the market clearly does.

#7 - Pro-business regulation will juice future profits

The current administration’s policies are seen as pro-business.

A low-regulation environment will lead to significantly more cash for these companies, as less is spent on fluff and more is returned to shareholders.

#8 - Finally… nothing matters anymore

The Fed Put.

Yolo.

Memes.

A complete loss of institutional trust.

Sneaky and infinite QE.

Nothing matters and not enough people care.

Our reality is now a big casino and the only winning move is to roll with it.

So there you have it, the eight possible reasons why the market may not be as extreme as it looks on the surface.

Is that what I actually believe?

Well, no.

I believe in up-only about as much as I believe in the Easter Bunny.

But what's a skeptic to do?

If you’re not inclined to believe in fairy tales, then Howard Marks’ recent letter laid out different “DEFCON” levels a pessimistic investor can reach.

They are:

6. Stop buying

5. Reduce aggressive holdings and increase defensive holdings

4. Sell off the remaining aggressive holdings

3. Trim defensive holdings as well

2. Eliminate all holdings

1. Go short

This decision is even more tricky for our assets sitting in taxable accounts.

You may think we’re about to go full Chernobyl, but are you willing to wager 20% long-term capital gains on that bet?

Think hard.

The easiest move for most good DCA’ers is simply to change where your regular allocations go.

I usually split about half of my allocations to a basket of ETFs, and the other half to private market assets.

So what'd I do?

I simply shifted my DCA’ing into other less extreme asset classes, ones in more promising lands beyond my own.

It’s the lowest, level-6, DEFCON move.

I certainly do not know what comes next, but again to borrow from Howard Marks, I can see where the pendulum has swung.

Good luck out there 🫡

Huge Disclaimer in Smaller Font

This content is being provided for information and discussion purposes only and should not be seen as a recommendation to do anything at all, especially not to buy or sell a security. Opinions expressed are that of the author, who is NOT a registered investment adviser, or a financial professional, or can barely even tie his shoes half the time. Do not try and copy the author or you’ll probably lose all of your money and have a rather bad day. There will also be affiliate links in here because he likes easy money.